Backed by a “green premium” alone? The industry reviews spider silk biological manufacturing barriers, need to pay more attention to high-value product applications

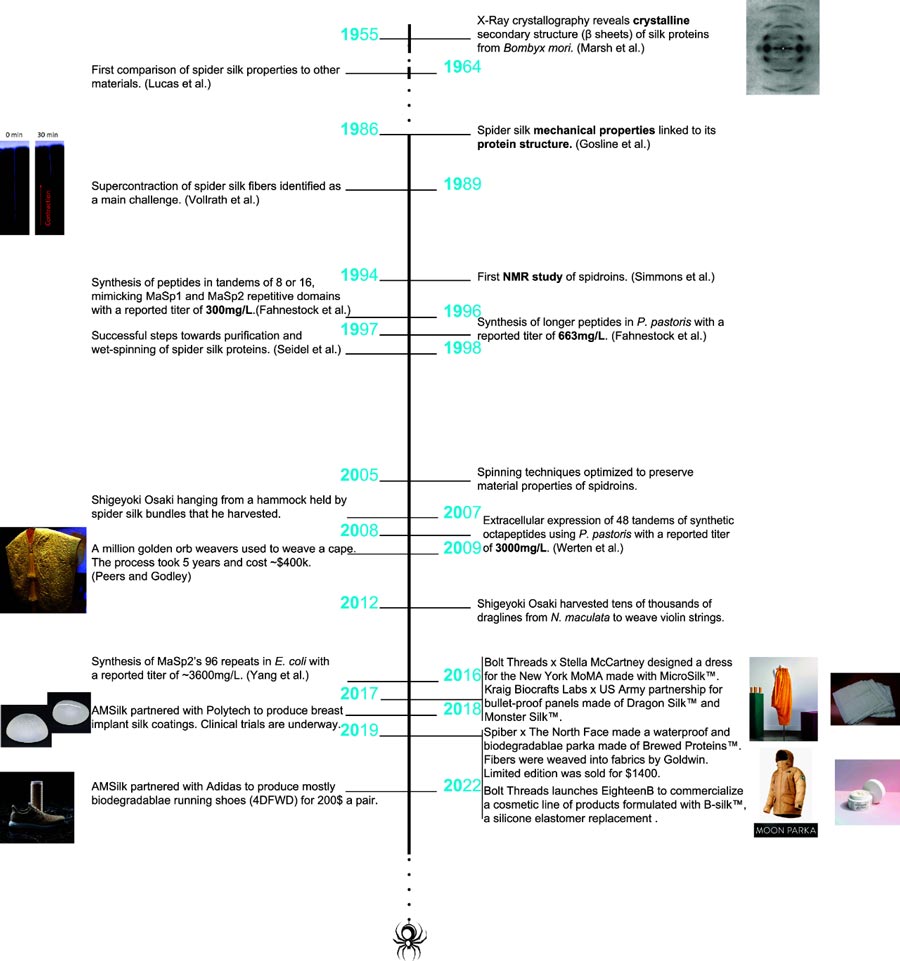

In 2012, the Victoria and Albert Museum exhibited a cape and cape made from natural spider silk. The costumes were the result of a unique project that took eight years and involved harvesting spider silk from 1.2 million spiders.

In 2019, THE NORTH FACE partnered with Spiber to launch Moon Parka, the world’s first commercially available coat made from spider silk protein produced by a microbial fermentation process.

The name comes from the word “moonshot,” which means to attempt an extremely difficult task in order to make a big impact.

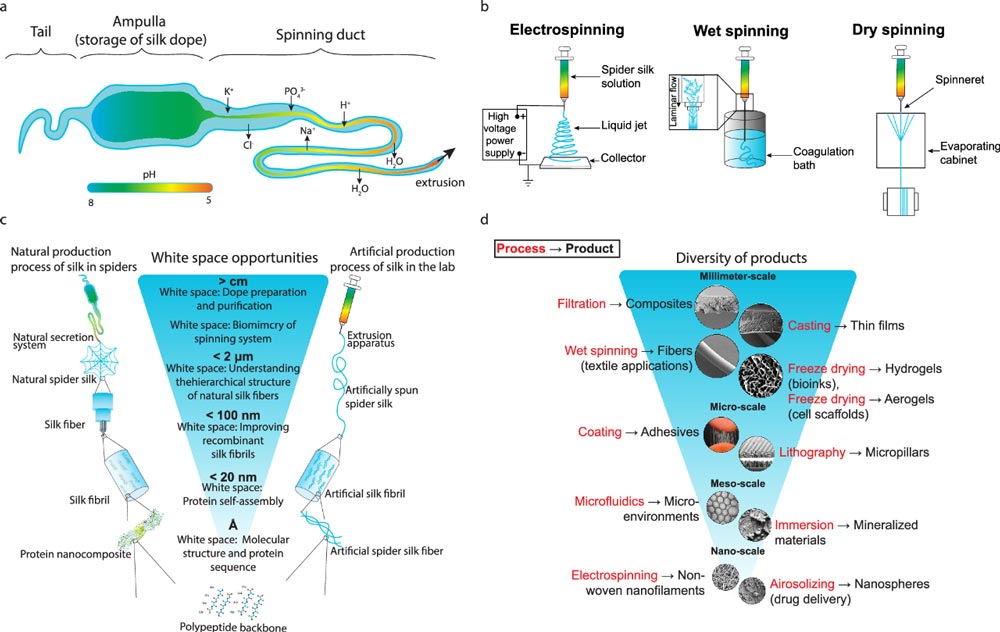

Spider silk is composed of a variety of amino acids, and its unique and recurring polyalanine and glycine sequences determine the mechanical properties, elasticity and toughness of spider silk fibers.

Its extraordinary material properties are making it a promising alternative to many petrochemical-derived materials.

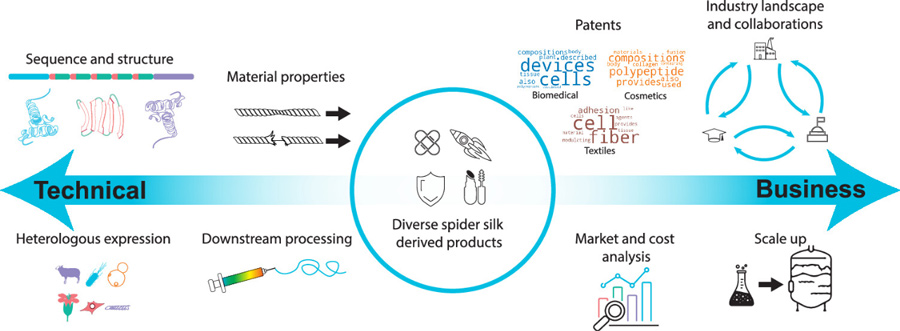

Interest in heterologous production of spider silk proteins has increased considerably over the past few decades, making recombinant spider silk an important frontier in biofanufacturing.

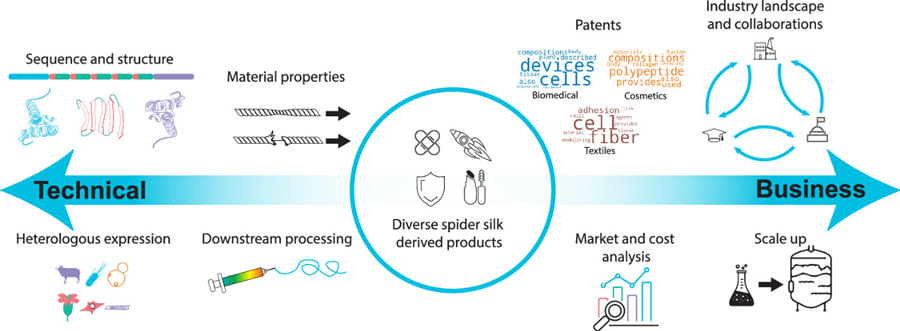

Thus, a variety of potential host organisms, sequence design modification, and downstream processing technologies and product applications for spider silk production are derived.

1. Adjust the material properties of spider silk

Most insects produce only one type of silk in their lifetime, but spiders are capable of producing seven main types of silk, and they can adjust the type of silk they secrete for different purposes, such as cocooning, swelling, and catching prey.

Spiders often utilize and combine the different properties of different types of silk to maximize function.

To date, more than 41,000 species of silk-producing spiders have been identified, each with a unique type of silk.

The dragline of Nephila clavipes (Araneus aureus) and Araneus diadematus (European garden spider) has become a model material, has been well characterized in the laboratory and has aroused the greatest interest in industrial production.

Drag silk plays a role in the swelling of spiders, that is, spiders use silk to fly through the air and move with the wind, thus being able to travel great distances.

Natural dragline has excellent tensile properties, toughness and elasticity.

The two proteins most clearly characterized in N. clavipes are MaSp1 and MaSp2.

The most well characterized spider silk proteins in A. diadematus are ADF-3 and ADF-4.

Based on these advances, representative companies in the field of recombinant spider silk have used sequences from N. clavipes or A. diadematus as the basis for product design and development, and they are keen to mimic the highly repetitive core domain of spider silk proteins.

An analysis of all patents issued in the field since 1987, based on publicly available information, found that approximately 2,500 patents were included. At present, about 200 new patents are added every year.

The patents filed by Spiber, AMSilk, and Bolt Threads, collectively known as ADF3, ADF4, MaSp1, and/or MaSp2, serve as the starting point for the initial design and testing of spider silk materials.

AMSilk, for example, has generated at least 20 unique versions of the spider silk sequence, all derived from A. diadematus.

In the field of biomaterials, there is also great untapped potential for recombinant draglines of non-pattern spider species, many of which have yet to be systematically explored.

Due to the inherent programmability of bio-manufactured proteins, any future recombinant silk fibers will likely have less and less of the characteristics of traditional spider silk sequences during iterative development cycles.

Many companies and research groups have moved away from natural spider silk proteins, using sequence optimization to enhance expression, fiber formation, and mechanical properties.

Hiroyuki Nakamura, a scientist at Spiber, highlighted the ability to alter the protein sequence to adjust the material properties of the resulting fibers:

Much of Spiber’s early work focused on solving the problem of supershrinkage, a property of natural spider silk.

While these initial spider silk sequences are at the heart of our research, our current Brewed Protein products have upgraded to achieve better mechanical properties.

The company closed a $65 million funding round in April 2024.

Keiji Numata, a professor at Kyoto University and leader of the Riken team, summarized the importance of how the sequence of spider silk proteins determines its properties, especially its toughness.

We need to focus on improving the resilience of spider silk.

In order to do this, it is necessary to understand the relationship between the hierarchy and mechanical properties of this material.

This requires us to understand the multiple levels that determine its hierarchy:

How amino acid sequences affect protein composition, and how protein composition affects the self-assembly process.

To date, recombinant spider silk proteins have produced in bacteria, yeast, eukaryotic cell lines, plants, insects, mammals, and several other emerging platforms.

Escherichia coli and Pichia pastoris currently dominate the field of recombinant spider silk and broader industrial bio-manufacturing, but continued interest in optimizing spider silk protein production enhances the potential for alternative hosts such as alfalfa plants, silkworms, and genetically modified mammals.

Roberto Velozzi, Chairman and CEO of SpideyTek, speaks highly of the alfalfa platform: Large-scale fermentation is not the future of spider silk production, alfalfa plants are.

Alfalfa plants are extremely productive and have powerful genetic tools to consistently produce native sized spider silk.

Thanks to improved agricultural infrastructure and the ability to resell alfalfa waste as animal feed pellets to farmers and other buyers, net production costs reduced to zero.

The industrial fermentation synthesis production method based on microorganisms (such as Escherichia coli, yeast, etc.) limited by the size of the fermented protein, usually proteins below 100 kDa relatively easy to produce, and proteins greater than 100 kDa will significantly decrease in yield and yield.

The size of natural spider silk proteins is usually between 300-700 kDa, and it is difficult to achieve full size with microbial fermentation.

Wang Boxiang, CTO and co-founder of Linghu Technology, said in an interview with Shenghui.

The design of spider silk fibers, the required scale and yield, and specific downstream applications may ultimately lead researchers and companies to adopt more suitable hosting platforms in the future.

2. Industry and research cooperation to jointly promote the development of the field

Every year, new startups step in to mass-produce spider silk.

They also have partnerships with consumer brands, such as Spiber with The North Face, Archer Daniels Midland, and Toyota;

AMSilk has partnered with Airbus, Mercedes Benz and Adidas;

Bolt Threads has partnered with Kering Group, Lululemon, Adidas and Stella McCartney.

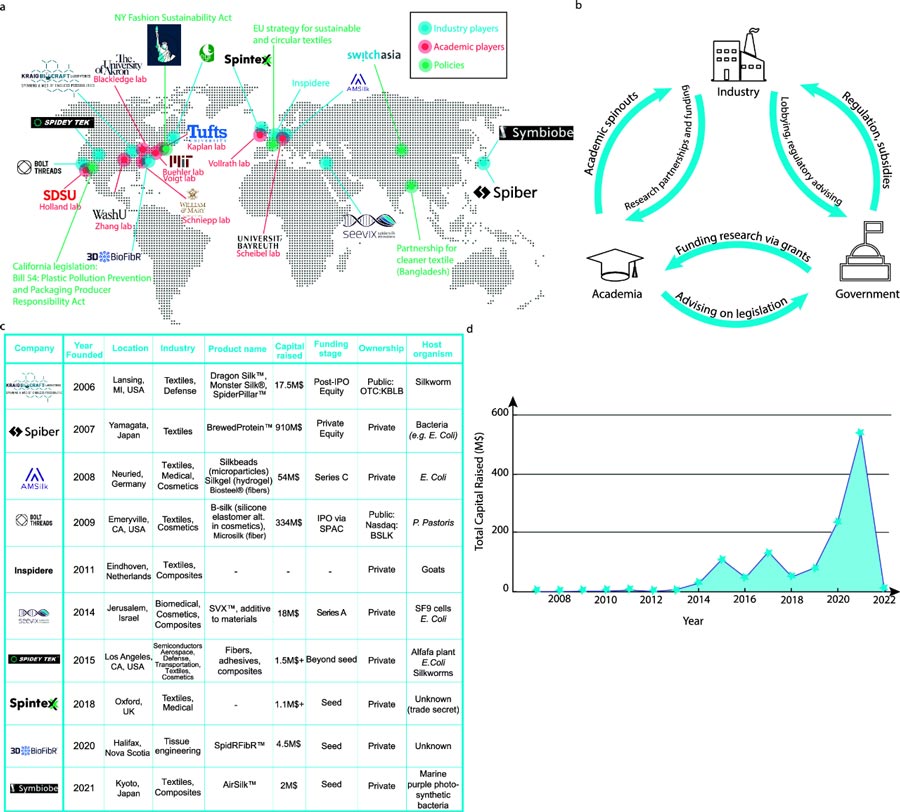

A global survey of spider silk companies, academic LABS, and local policies that encourage the development of sustainable materials found that innovation in the field being driven primarily in North America, Europe, and Japan.

The links between academia and industry are particularly important.

AMSilk co-founded by Dr. Thomas Schiebel, professor of biomaterials at the University of Munich, who worked on recombinant spider silk;

Bolt Threads is also the result of an interdisciplinary collaboration between three graduate students who met through a shared interest in biomaterials;

Spidey Tek founded by Roberto Velozzi and Professor Randolph Lewis, a world expert in the field of spider silk research.

Companies can also partner with academic LABS to fund their own in-house research projects, outsourcing some of the high-risk basic science needed to optimize production processes.

Spiber, for example, has close ties with Kyoto University.

In addition to the close links between academia and industry, governments are also building thriving ecosystems in the field of sustainable biomaterials.

For example, the European Union proposed a Sustainable and Circular Textiles Strategy (2023), which states that “by 2030, textiles placed on the EU market will be durable and recyclable, made to a large extent from recycled fibres, free from harmful substances, and produced with respect for social rights and the environment”.

Since the mid-2000s, there have been a number of companies that have completed funding rounds, most are currently in the Series C or D (pre-IPO) stage, and a few have gone public.

Kraig Biocraft went public in 2008, two years after it founded, and its share price has remained relatively flat, except for a notable surge in 2019, likely due to the company’s Vietnamese subsidiary Prodigy Textiles raising its first production silkworm;

Bolt Threads, a producer of bio-based ingredients, recently successfully completed its Merger with Golden Arrow Merger Corp, a special purpose acquisition company, and began trading on Nasdaq on August 14, 2024.

Before 2021, the funds flowing into the field rose year by year, and reached a peak in 2021, and the sharp decline in funds in 2022 was related to the general downturn in the market and the decrease in venture capital investment in the year.

For Sydney Gladman, chief strategy officer at the Material Innovation Initiative and a veteran of the biomaterials sector, trends are the way the fashion industry works, which is why interest in sustainable products such as spider silk can come in cycles.

However, there are other potential properties of the material that are helping to bring renewed attention to the industry.

Regardless of the state of the economy, brands are still competing for the next generation of materials, and funding may decrease, but demand will not.

The bleak market environment has also led some companies to abandon the research and production of spider silk, Bolt Threads is currently more focused on the development of materials in the field of cosmetics;

3DBiofibr abandons spider silk fibers due to high production costs and unbalanced market demand, and uses its experience in fiber materials to move to new markets, such as collagen fibers for tissue engineering;

Companies such as Seevix have turned their efforts to producing shorter spider silk that can used as an additive or combined with other materials to form composites or chimeras.

Given that spider silk production at an early stage and risky, spider silk companies mostly funded by private venture capital firms.

Bolt Threads co-founder Dr. Ethan Mirsky said: “The production of recombinant spider silk fibers is a very difficult problem.

I don’t know if there are any magic solutions!

The question to answer: Can you produce enough volumes at a low enough price and perform well enough to guarantee that your material will produced, the key to efficiently and economically translate your technology into an economically viable product.

3. Target high value products

For some researchers, overcoming toxicity is a major building block to increasing yields, a view shared by Professor Mattheos Koffas, PhD, of Rensselaer Polytechnic Institute.

Our work has shown that increased expression of spider silk proteins leads to enhanced toxic effects on cells, mainly due to the disordered nature of the proteins.

To scale up spider silk production and achieve competitive yields, we must understand and mitigate the sources of this cytotoxicity.

At this stage, toxicity is likely to be the number one issue preventing proper scale-up.

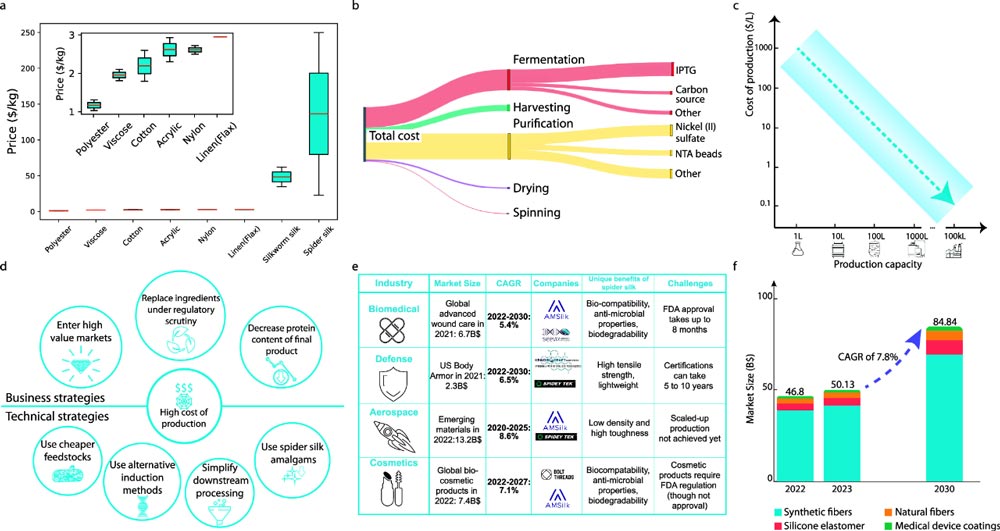

Cost is one of the current barriers to spider silk research.

The production process of spider silk divided into five main steps: fermentation, harvesting, purification, drying and spinning, and the total production cost about several hundred dollars per kilogram.

At present, in order to reduce production costs, many laboratories and companies have begun to streamline and optimize the production process, such as through the easy recovery of exogenous labeled proteins, or through the real-time secretion system to simplify the harvest process, thus bypassing this step completely, making the purification step easier;

Other companies have switched from glucose to glycerin, which is cheaper and more readily available and has shown promise for increasing stem cell weight and boosting yields.

It also takes a lot of money to expand production.

Since large fermentation facilities require an investment of around $300 million, many companies initially choose to entrust their mass production to cmos and CDmos.

A global microbial fermentation database called Capacitor shows that more than half of companies ready to scale up need bioreactors with a capacity of more than 20,000 liters, but only 23% of existing facilities can meet this requirement.

The severe mismatch between supply and demand for large-scale bioreactor facilities also expected to keep production costs high.

Some industry experts believe that the supply and demand of reactor facilities can balanced by adding fermentation infrastructure or retrofitting existing fermentation infrastructure, such as breweries, distilleries or ethanol plants.

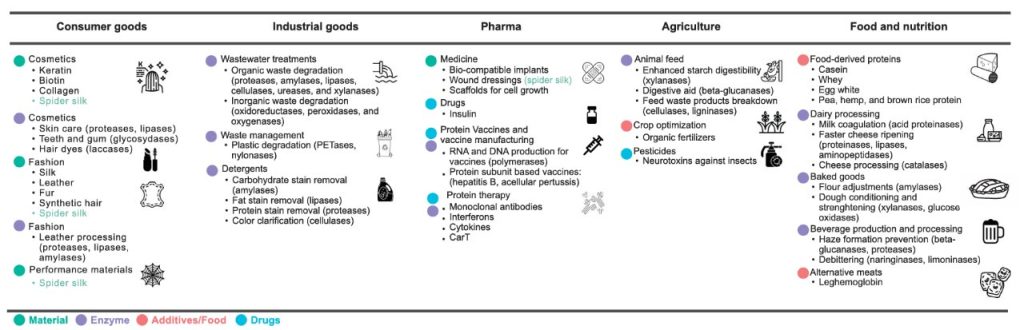

Given the many similarities between silk and spider silk, one of the most obvious application markets for spider silk is textiles.

The “green premium” alone may not make spider silk consistently competitive in the market.

To find a way out, companies can adjust their business objectives and choose to enter high-value markets, such as materials used in medical devices that require higher standards for biocompatibility, antimicrobial properties and biodegradability, often with a higher price range than fibers used in textiles;

The beauty industry is also full of opportunities, such as silicone coated breast implants with spider silk can improve biocompatibility;

Due to the high toughness and low density of spider silk, it can used in defense, aerospace and automotive related products.

For example, Kraig Biocraft is working with the US Department of Defense on the production of bulletproof materials;

Spiber, in partnership with Toyota and SpideyTek with Velozzi, has promised to launch some pilot products in the next few years.

Shinya Murata, head of business development at Spiber, pointed out that the automotive industry will be a key business direction for Spiber in the future.

“Contributions from spider silk include leather upholstery for seats and composites for automotive structural components, and we are currently investigating how to incorporate spider silk into composites to greatly improve their mechanical properties, with the first products expected to released soon.”

It is clear that the market potential for spider silk is still huge, with a potential market size of $50 billion, but it is currently largely untapped.

With the iteration of technology and the decline of costs, the commercialization and market of spider silk biologic manufacturing expected to usher in a new stage.

To find a way out, companies can adjust their business objectives and choose to enter high-value markets, such as materials used in medical devices that require higher standards for biocompatibility, antimicrobial properties and biodegradability, often with a higher price range than fibers used in textiles;

The beauty industry is also full of opportunities, such as silicone coated breast implants with spider silk can improve biocompatibility;

Due to the high toughness and low density of spider silk, it can used in defense, aerospace and automotive related products.

For example, Kraig Biocraft is working with the US Department of Defense on the production of bulletproof materials;

Spiber, in partnership with Toyota and SpideyTek with Velozzi, has promised to launch some pilot products in the next few years.

Shinya Murata, head of business development at Spiber, pointed out that the automotive industry will be a key business direction for Spiber in the future.

“Contributions from spider silk include leather upholstery for seats and composites for automotive structural components, and we are currently investigating how to incorporate spider silk into composites to greatly improve their mechanical properties, with the first products expected to released soon.”

It is clear that the market potential for spider silk is still huge, with a potential market size of $50 billion, but it is currently largely untapped.

With the iteration of technology and the decline of costs, the commercialization and market of spider silk biologic manufacturing expected to usher in a new stage.

Reference link:

- Guessous G, Blake L, Bui A, Woo Y, Manzanarez G. Disentangling the Web: An Interdisciplinary Review on the Potential and Feasibility of Spider Silk Bioproduction. ACS Biomater Sci Eng. 2024 Sep 9;10(9):5412-5438.